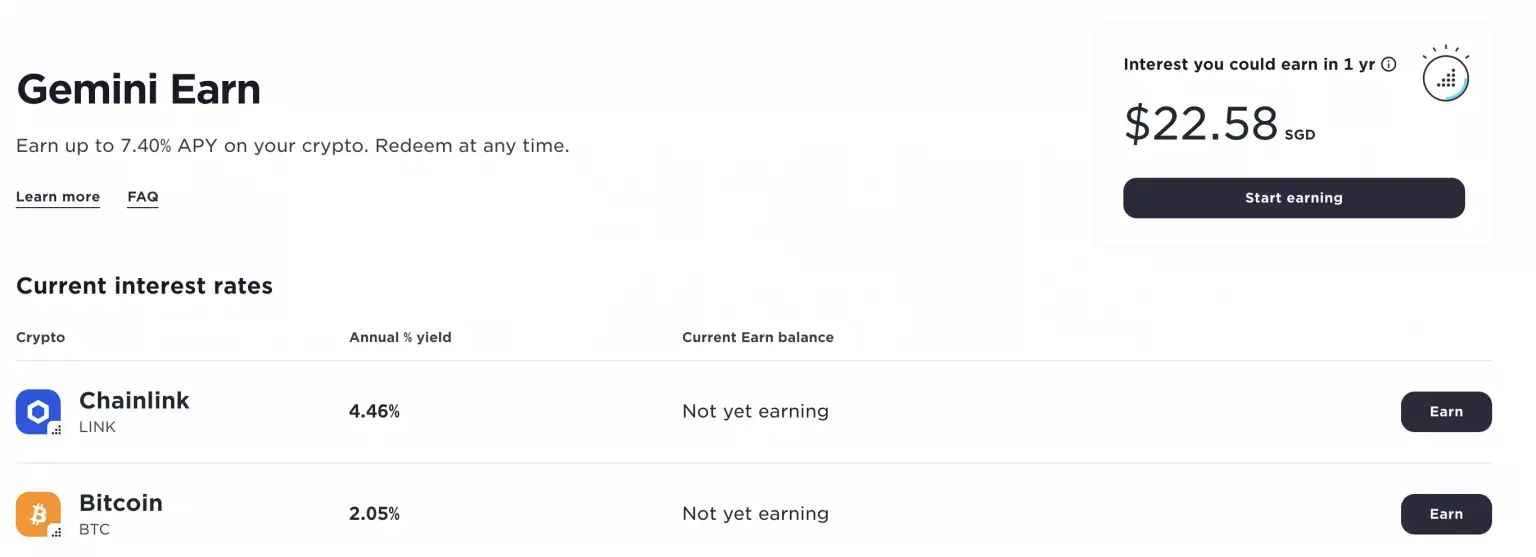

It has built its reputation with a suite of products and features, such as the Gemini exchange and wallet, a stablecoin GUSD, and Gemini Pay, a feature for users to pay with crypto at traditional businesses like Bed, Bath and Beyond. Gemini is regarded as a pioneer in the cryptocurrency industry. Gemini Earn enables users to transfer funds into an “Earn” account and get up to 7.40% APY on BTC, ETH, stablecoins, and other altcoins. The crypto market suffered greatly after the FTX saga, and the contagion effect spelled trouble for multiple crypto entities.Gemini Earn is a cryptocurrency interest account feature on the cryptocurrency exchange Gemini. Genesis’ exposure to not bankrupt FTX created troubles for Gemini, as most of the assets were stuck in the scenario. The SEC filing with the Manhattan federal court said that Genesis failed to register this product as a securities offering. Genesis would take Gemini users’ crypto for further investments and then return the portion after deducting the agent fee of around 4%. The partnership between Genesis and Gemini came into existence in February 2021, bringing the Gemini Earn program to offer its customers a yield of up to 8%. Gemini terminated their Earn program a day after the case filing due to some disputes with crypto lender Genesis. In January 2023, the Securities and Exchange Commission (SEC) filed against Genesis Global Capital and Gemini regarding the selling and offering unregistered securities, which were facilitated through the Gemini Earn crypto lending program. Right now, they operate in around 60 countries worldwide. They soon started operations in Singapore, Hong Kong, South Korea, and Japan to cater to the Asian market. Gemini went live for US customers in October 2015 and went international by mid-2016 when they expanded in Canada and the UK.

#Should i use gemini earn movie

The incident was also referred to in the movie “The Social Network.” the twins were believed to be studying with Mark Zuckerberg at Harvard University. The twins are well known for a $65 million settlement with Mark Zuckerberg, claiming that Facebook was originally their idea and was stolen by him. The Winklevoss twins are the company’s majority shareholders. Since its inception in 2014, the crypto exchange has added a payment app, an interest-paying savings account, a trading platform, and a credit card. Gemini supports trading in more than 120 cryptocurrencies. Their stablecoin, the Gemini dollar, is linked to the US Dollar. Interestingly the crypto exchange offers a tiered service, separate for casual investors and dedicated traders. is a privately owned cryptocurrency exchange facilitating the buying, selling, & trading of more than 60 cryptocurrencies. A Brief About Gemini Crypto Exchange and Winklevoss Twinsįounded in 2014 by the Winklevoss twins, Gemini Trust Co. Notably, no data is available to relate the $100 Million loan and $100 Million Earn commitment.

At the same time, Gemini is said to contribute around $100 million to Earn users.

Genesis’ attorney said the company had made a pact with the creditors. While Genesis was recovering from bankruptcy, DCG agreed to a settlement in February 2023 to sell its subsidiary, including its crypto trading business and lending arm.

This step inadvertently locked customers’ money in Gemini’s Earn yield product. Genesis is owned by the Digital Currency Group (DCG), and after the FTX saga was unveiled, they halted the withdrawals. This $100 million loan is crucial as it is the same amount Gemini promised to give a few of its customers in the Genesis bankruptcy case. However, Gemini’s spokesperson did not respond to a media request for comment. Tyler and Cameron provided this loan to their crypto platform after trying to raise money from outside. Media reported that the Winklevoss twins poured $100 Million in Gemini to fight the market plunge.

2 SEC had sued Gemini Earn program regarding unregistered securities.1 Winklevoss twins tried raising money from outside but ended up loaning $100M to Gemini.

0 kommentar(er)

0 kommentar(er)